FrankJScott

Зарегистрирован: 26.08.2022

Сообщения: 8803

Откуда: 메이저사이트

|

Добавлено: 16.01.2023 10:23 Заголовок сообщения: Free Tips For Selecting Trade RSI Divergence Добавлено: 16.01.2023 10:23 Заголовок сообщения: Free Tips For Selecting Trade RSI Divergence |

|

|

4 Good Hints For Selecting An RSI Divergence Strategy?

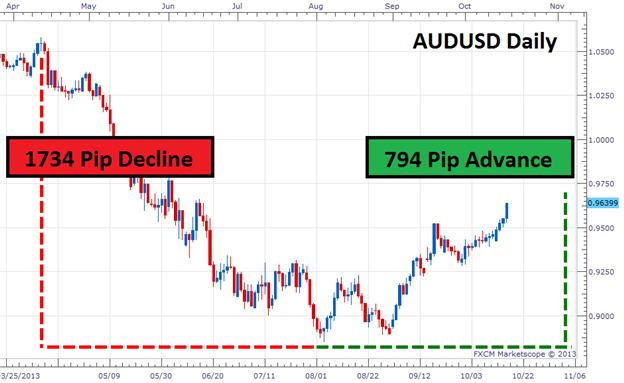

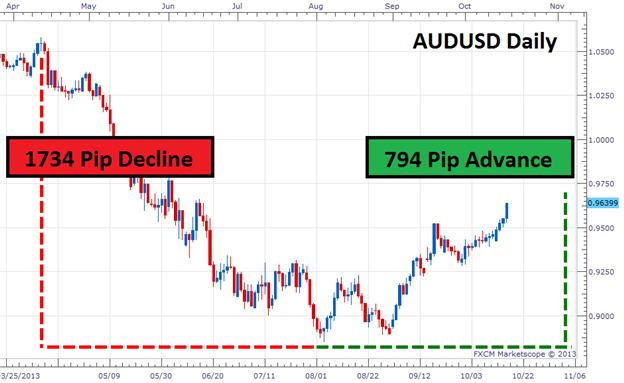

Let's start with the most obvious question. We'll explore the meaning of RSI Divergence actually is and the trading information we can get from it. The Divergence happens on your chart when the price action and RSI indicator are out of the alignment. In downtrend markets where the price action creates lower lows while the RSI indicator is able to make lower lows. Divergence occurs when the indicator isn't in accordance with price action. If this occurs it is crucial to keep an eye on the market. Based on the chart, both bullish RSI divergence as well as the bearish RSI divergence are clear and, the price action actually reversed after both RSI divergence signals. Is that right? Let's look at one final issue before moving on to the topic that is exciting. Have a look at the top forex backtest software for site recommendations including tradingview auto, auto fx trader, forex training courses, professional crypto trader, rsi divergence indicator for mt4, bullish rsi divergence stocks, forex lessons, forex news sites, reverse divergence rsi, auto share trading software, and more.

How Do You Analyze The Rsi Divergence

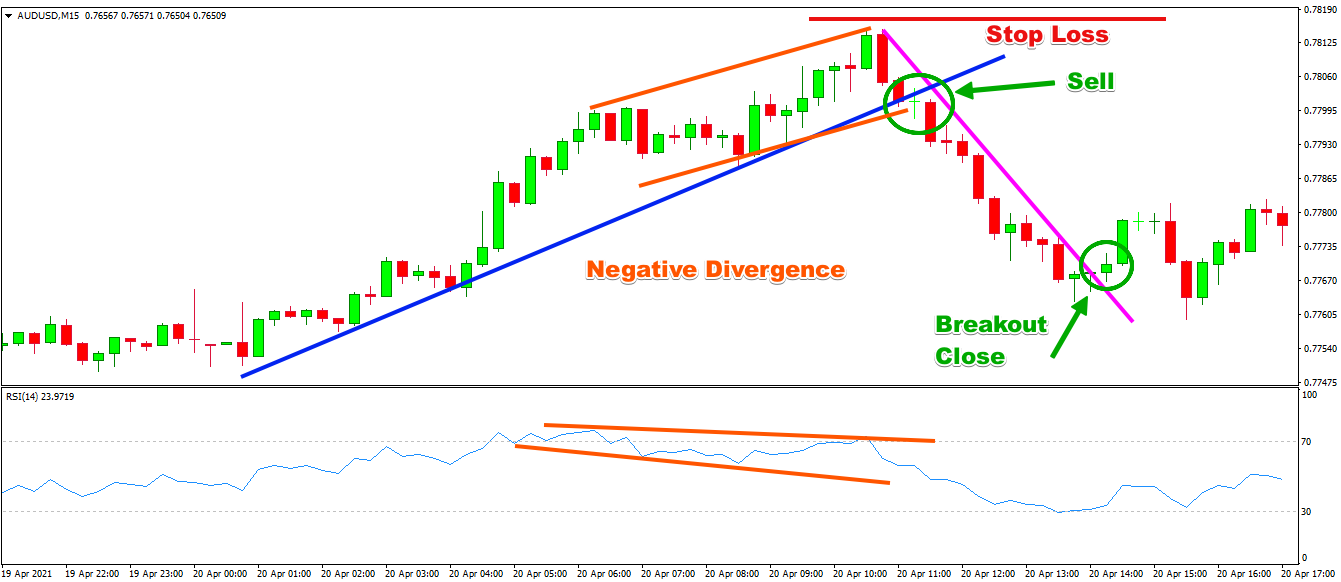

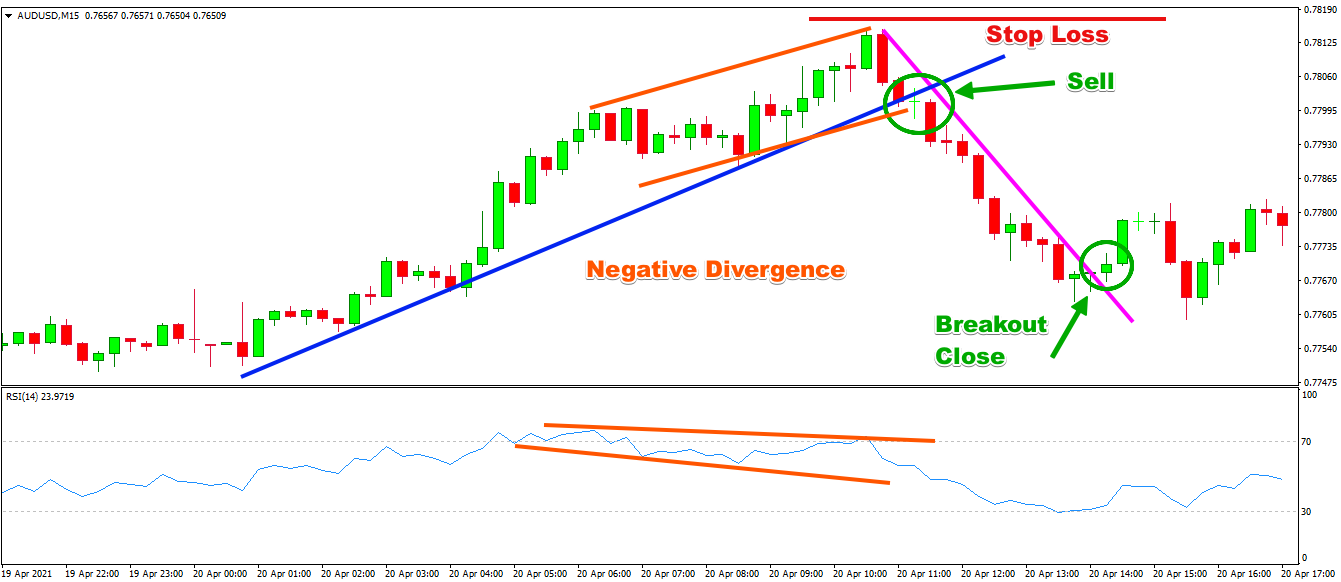

Since we employ the RSI indicator for identifying trends that are reversing, it is very important to identify the correct trend reversal in order to do this, we need to have an uptrending market. Then we use RSI divergence to find the weak points of the current trend and then use this information to spot the trend's reversal at the right moment.

How Do You Spot Rsi Divergence During Trading Forex

Both Price Action and RSI indicators both formed higher highs at the start of the trend up. This means that the trend is stable. However, at the end of the trend, Price makes higher highs. However, the RSI indicator made lower highs which indicate something to be watched on this chart. This is the time be paying attention to the market since both the indicator and price are out of sync, that's a sign of the market is experiencing an RSI divergence, right? In this case, the RSI divergence is a sign of a bearish trend change. Take a look at the chart and look at what happened following the RSI split. The RSI divergence is highly precise in identifying trend reverses. The question is: how do you actually detect the trend reversal, right? Let's look at 4 practical trade entry techniques that offer higher-risk entry signals when paired with RSI divergence. See the top rated backtester for site recommendations including best way to trade crypto, deribit options, ftmo trading, proven best forex indicators, forex website, automated trading for beginners, stocks automated trading system, 3commas, mt4 webtrader, automated stock buying selling program, and more.

Tip #1 – Combining RSI Divergence and the Triangle Pattern

Triangle chart pattern comes in two different variations. There is an Ascending triangular pattern that works in the downtrend. The pattern of the descending triangle can be used to reverse the trend of a market when it is in an upward trend. The chart below illustrates the downwards Triangle pattern. In the earlier example, the market was still moving up, but later the price started to decrease. RSI is also a sign of divergence. These indicators are indicative of the downfalls of this upward trend. This indicates that the current trend is losing its momentum. Price formed a triangle-shaped pattern which resembles a downward spiral. This confirms the reverse. Now is the time to start short trading. Like the previous example we utilized the same techniques to break out for this trade as well. Let's now get to the third entry method. This time , we'll combine trend structure and RSI diversification. Let's see how you can trade RSI divergence in the event that the trend structure is changing. View the recommended crypto trading for blog info including arbitrage coin, 4x trading, best forex broker in the world, trading robot, expert advisor programming, fxhours, cme crypto futures, auto buy sell trading software, td ameritrade cryptocurrency, huobi bot trading, and more.

Tip #2 – Combining RSI Divergence and the Head and Shoulders Pattern

RSI divergence is an instrument used by forex traders to identify market reversals. It can help make your trade more likely by combing RSI divergence with another potential reversal factors like the Head and Shoulders pattern. Let's take a examine how we can predict trades by combing RSI divergence with the Head and Shoulders pattern. Related: Forex Head and Shoulders Pattern Trading Strategy - Reversal Trading Strategy. An enviable market conditions are required before you can trade. If we wish to see any change in the trend then it is best to have a strong market. The chart is below. View the most popular backtesting tool for site tips including automated high frequency trading, auto pilot trading forex, metatrader broker, reddit crypto trading, ftmo ea, best crypto to trade today, mt4 market, nifty live auto trading system, exchange blockchain, xtb brokers, and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

Trends are our friends, right! If the market is trending, we need to be trading in the direction of the trend. This is the way that professionals train. This trend doesn't last for a long time. It is bound to change direction at some moment. Let's look at how we can recognize those reversals by observing the structure of trends and RSI Divergence. We know that the uptrend is making higher highs while the downtrend has lower lows. Now with that in mind have a look at the chart below. When you take a look to the left of this chart, you'll observe that it's an downtrend that has a pattern of lower highs and lows. You can also see the RSI deviation (Red Line). Price action causes Lows but the RSI makes higher lows do you think? What's the meaning of all this? Despite the fact that the market creates low RSI it is doing the opposite. This suggests that the current downtrend has lost momentum. It is important to be prepared to see a reversal. Read the top automated trading platform for more examples including fxblue simulator, get free funded forex account, cryptocurrency simulator, interactive brokers automated trading, low spread brokers, wazirx automated trading, interactive brokers forex, fbs copy trade, cryptocurrency trading, etoro metatrader, and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

Double-bottom is a reversal chart which forms after a long move or a trend. Double tops form when prices reach an unbreakable threshold. When it reaches that point it will then retrace little before returning to the original level. A DOUBLE TOP occurs where the price bounces off that mark. Below is an example of a double top. The double top above illustrates that the two tops were formed after a strong move. The second top is unable to over the one. This is a clear indication that buyers are struggling to move higher. Double bottoms also employ the same principles but is executed in a different direction. We employ the strategy of breakout trading. This means we sell the trade when the trigger line is beneath the price. We took our profit after the price was below the trigger line. QUICK PROFIT. Double bottoms can be traded using the same techniques. The chart below shows how you can trade RSI Divergence using Double Bottom.

Remember that this isn't the perfect all trading strategy. There is no such thing as a perfect trading strategy, and all strategies for trading suffer from losses and they must be dealt with. Although we make consistent profits with this trading strategy We also employ a strict risk management and a fast way to cut down our losses. That will reduce our drawdown and provide huge upside potential. Read more- New Hints For Deciding On Trade RSI Divergence dd3f714 , Best Ideas For Deciding On Trade RSI Divergence and Recommended Info For Deciding On Trade RSI Divergence. |

|